During the 2022 Virginia General Assembly Session, legislation was enacted to conform with the Internal Revenue Code’s Covid-19 response legislation. Tax Bulletin 22-1 was released on February 23, 2022 and provides in depth information about the relief. Here are some important updates about the treatment of forgiven Paycheck Protection Program (PPP) proceeds:Taxable Year 2020: The law remains the same – a Virginia-specific deduction for $100,000 in business expenses that were paid or incurred and are funded by forgiven PPP proceeds during Taxable Year 2020, is allowable on the 2020 tax returns. Taxable Year 2021: Virginia will conform to the federal tax law treatment of the COVID-19 business assistance programs for tax year 2021 and after. No adjustment is required on the 2021 Virginia income tax returns for taxpayers that have business expenses funded by forgiven PPP loan proceeds, EIDL program funding, and Restaurant Revitalization grants during 2021.

Category: Covid-19 Information

COVID Programs (PPP/EIDL/PUA)

In 2020 new programs were created to help small businesses including forgiven loans, grants, and unemployment benefits.

PPP Forgiven Loan

The CARES Act states the forgiven loan amount will not be included in your taxable income and you will not pay taxes on the money received. The second stimulus bill on December 27, 2020 clarified how the expenses covered by a PPP loan will be treated. Previously, IRS guidance stated anything you spent your PPP loan proceeds on were not going to be tax deductible. Congress clarified that – now your expenses are tax deductible. Schedule C filers will not be impacted by their PPP forgiven loans.

EIDL Grant

The second stimulus bill clarified that the EIDL grant will also be tax-free and will not need to be included in your taxable income. An EIDL loan will be treated the same way as any other loan.

Pandemic Unemployment Assistance (PUA) and Unemployment

PUA and Unemployment benefits are considered taxable income. You will pay state and federal taxes on money you received, but will not have to pay medicare or social security taxes on the income.

Deferring Payroll Tax Obligation: Is it right for your business?

The Executive Order, Memorandum on Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster, issued by President Trump on August 8, 2020, permits deferral of employee OASDI taxes for payroll dates on and after September 1, 2020 through December 31, 2020. The IRS issued guidance on August 28, but there are still many unanswered questions. Employers have a choice to continue to withhold and deposit employee OASDI (Old Age, Survivors and Disability Insurance) taxes as usual. If they decide to implement the executive order, employers will be required to remit taxes next spring for all employees, including ones who may have left the company for any reason. This liability becomes the employer’s debt.

If the employer elects to implement the order, the following is applicable:

Employers can defer the withholding, deposit and payment of the employee portion of the OASDI segment of FICA taxes. Payment of the employee OASDI tax is only deferred, not forgiven. Employees are still obligated to pay the taxes. If an employer does elect to defer payment of an employee’s OASDI taxes, the employer is required to withhold and pay those deferred taxes later. From January 1, 2021 to April 30, 2021, the employer must “ratably” deduct any deferred employee OASDI taxes from the wages paid to the employee, and pay them over to the IRS. If those deductions and payments are not made, penalties and interest will begin to accrue on the unpaid taxes on May 1, 2021.

- Deferral of employee OASDI taxes is limited to employees with bi-weekly pay of less than $4,000 (Applicable Wages) on a pre-tax basis. An employee with variable pay (commissions, overtime, or a bonus) could be eligible for deferral in one payroll period in which they have less than $4,000 of pay, but not eligible in the next payroll period if their pay exceeds $4,000.

Employers that implement the deferral will need to address situations in which employees with deferred taxes terminate employment before the deferred taxes are collected (later in 2020 and before April 30, 2021). Employers will want to structure “arrangements to otherwise collect” the deferred taxes in this circumstance by collecting the taxes from a final paycheck or by separate check from the employee. Notice 2020-65 does not provide any relief to an employer if there are circumstances that prevent the employer from collecting if the employee terminates employment, has a leave of absence, or otherwise does not have sufficient wages in 2021 to accomplish the required deductions for the previously deferred employee OASDI taxes. Employers in this situation are obligated to pay the tax.

- Code Section 6672, commonly called a “responsible person” penalty, can apply if an employer deducts amounts from an employee’s wages for employee social security taxes and/or income tax withholding, and the employer then fails to pay those amounts over to the IRS. In that case, the individual who is responsible (e.g., a CFO or CEO) can be held personally liable for the withheld taxes that were not paid over to the IRS. Notice 2020-65 does not provide any relief in relation to the potential application of the responsible person penalty under Code Section 6672.

While Notice 2020-65 clearly states that employers are not required to defer withholding of the employer portion of Social Security taxes on Applicable Wages of all employees, it does not address whether employers must honor requests by employees to have their Social Security taxes deferred in accordance with the Notice. Bloomberg Tax reported on September 3, 2020, that an IRS representative confirmed during its monthly payroll industry teleconference that employers do not need to implement the deferral at the request of employees. As a result of that teleconference, many of the larger payroll companies have elected not to provide support for implementation because they are struggling with the technology constraints and lack of clarity.

Employers should work with their CPA and legal counsel to determine how and when it should implement the guidance in the Notice. Please contact us at The Hopkins Group for assistance.

Stimulus Checks (Recovery Rebates)

What year will the IRS use to determine my stimulus? The IRS will use your 2018 or 2019 tax returns to determine the amount of your check. The actual credit will be calculated on your 2020 Form 1040. Any advance rebate paid to the taxpayer will reduce the amount of credit in 2020, but not below -0-. The law is written to provide for a payment to taxpayers if the 2020 credit calculation exceeds the rebate already received by the taxpayer. And, if the actual 2020 credit is less than the rebate, the taxpayer is not required to pay back any of the excess cash received. If your income for the year used is higher than your 2020 income you should receive a tax credit in 2020.

What if you tried the “Get My Payment” tool and you received a message that says “Payment Status Not Available”?

According to the IRS:

- You aren’t eligible for a payment.

- Your payment is based on your status as a Social Security, disability, Veterans Affairs or Railroad Retirement beneficiary. In this case, the IRS will use your SSA or RRB Form 1099 payment information. Your payment information isn’t available on the Get My Payment tool.

- You have not filed a 2018 or 2019 federal tax return.

- You filed your 2019 return, but it hasn’t been fully processed.

- You used the non-filers tool, but the information you entered is still being processed.

- There’s a problem verifying your identity when answering the security questions.

- If you don’t fall into any of those categories, keep checking “Get My Payment.” It’s possible that the system just hasn’t had time to process your information. Information on the site is updated only once a day. The IRS says people who qualify for a payment will receive it by mail if they do not get it through direct deposit.

COVID-19 Resources for Small Businesses

Economic Injury Disaster Loan via the Small Business Association

The Economic Injury Disaster Loan (EIDL)allows for up to $10,000 of economic relief to small businesses with less than 500 employees (including sole proprietorships, independent contractors and self-employed persons), private non-profit organization or 501(c)(19) veterans organizations affected by COVID-19. Funds will be made available within days of a successful application.

The SBA is unable to accept new applications at this time, but you can check the below link daily to stay updated on when additional funds will become available.

PPP (Paycheck Protection Plan)

The PPP provides a direct incentive for small businesses to keep their workers on the payroll since the SBA will forgive loans if all employees are kept on the payroll for eight weeks and the money is used for payroll, rent, mortgage interest, or utilities.

The Small Business Administration (SBA) is now accepting applications for Paycheck Protection Program loans.

QuickBooks is now available to a subset of customers, including multi-owner businesses*, using Intuit Online Payroll, QuickBooks Desktop Payroll on QuickBooks 2018, 2019, and 2020, QuickBooks Online Payroll, QuickBooks Self-Employed – users who filed 2019 taxes with TurboTax Self-Employed. Customers who receive notifications in their product should start their application now within QuickBooks Capital so they can submit applications to the Small Business Administration (SBA).

Other SBA COVID-19 Relief Options

Local Relief Funds

|

|

|

|

|

|

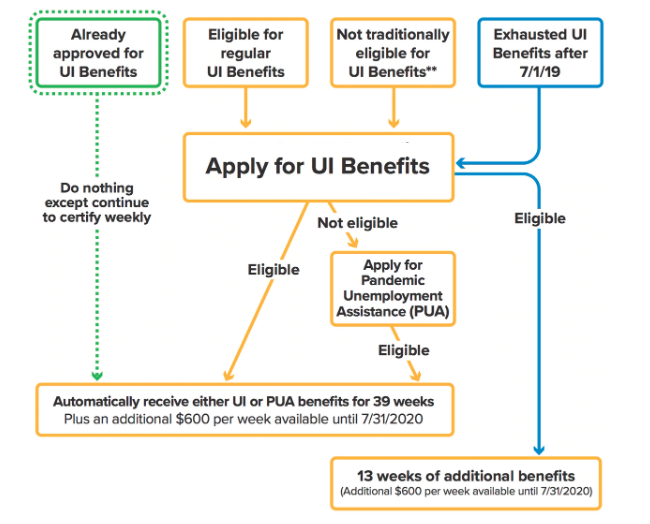

Unemployment Insurance for Non-traditional Persons

For non-traditional persons applying for UI insurance, you must:

- Apply and be denied for traditional Unemployment Insurance, with a letter of Monetary Determination via mail,

- Then apply via the PUA Program (Pandemic Unemployment Assistance) and wait for your Monetary Determination letter via mail.

The PUA program is available for 26 weeks plus with the PEUC (Pandemic Emergency Unemployment Compensation) program, that time frame is extended 13 weeks, for a total of 39 weeks of UI that you are eligible for. Plus under the Federal Pandemic Unemployment Compensation (FBUC) program you are eligible for an additional $600/week until July 31st, 2020.

Changes to Your IRA

Required Minimum Distributions (RMDs)

If you are age 70 1/2 before January 1, 2020 you are not required to take your 2020 distribution.

If you are aged 70 1/2 last year and were waiting until March 31 to take your 2019 distribution you are not required to take your 2019 RMD or your 2020 RMD. If you took your 2019 or 2020 RMD within the last 60 days you can roll over your distribution to the same or a different IRA within 60 days of the prior distribution and not pay the income tax on the withdrawal as long as you have not made an IRA withdrawal within the 365 days preceding your distribution. Inherited IRAs can take advantage of the RMD suspension for 2020 but they are not eligible for the indirect rollovers within sixty days.

Distributions

If you are 59 1/2 or younger, distributions of up to $100,000 are not subject to the 10% excise tax in 2020 or on early distributions (only for IRA owners affected by coronavirus).

Distributions of up to $100,000 this year can be reported evenly as income over 2020, 2021 and 2022 and/or repaid. You will not have to pay the tax on the distribution if you choose to repay the distribution to an IRA or other eligible retirement plan within three years of the distribution (only for IRA owners affected by coronavirus).

Owners affected by coronavirus must meet these requirements:

- Personally diagnosed with coronavirus

- Your spouse or dependent is diagnosed with coronavirus

- Experiencing adverse financial consequences as a result of:

- being quarantined,

- being furloughed or laid off,

- having reduced hours,

- being unable to work due to lack of childcare,

- closing or reduced hours of a business owned or operated by the participant, or

- any other factor determined by the Secretary of the Treasury.

Tax Deadlines

VA Income Tax Payment Extension & Penalty Waiver – Any Virginia income tax payments due during the time period of April 1, 2020, to June 1, 2020, will now be due on June 1, 2020. This includes individual and corporate income taxes. Late payment penalties will not be charged if payments are made by June 1, 2020. However, interest will still accrue, so if you can pay by the original filing due date, you should.

The IRS and most states have moved tax return due dates to July 15. Estimated tax filers should pay their second quarter estimated payment by June 15. First quarter payments are due July 15. If you have any questions about deadlines, please do not hesitate to contact our office.