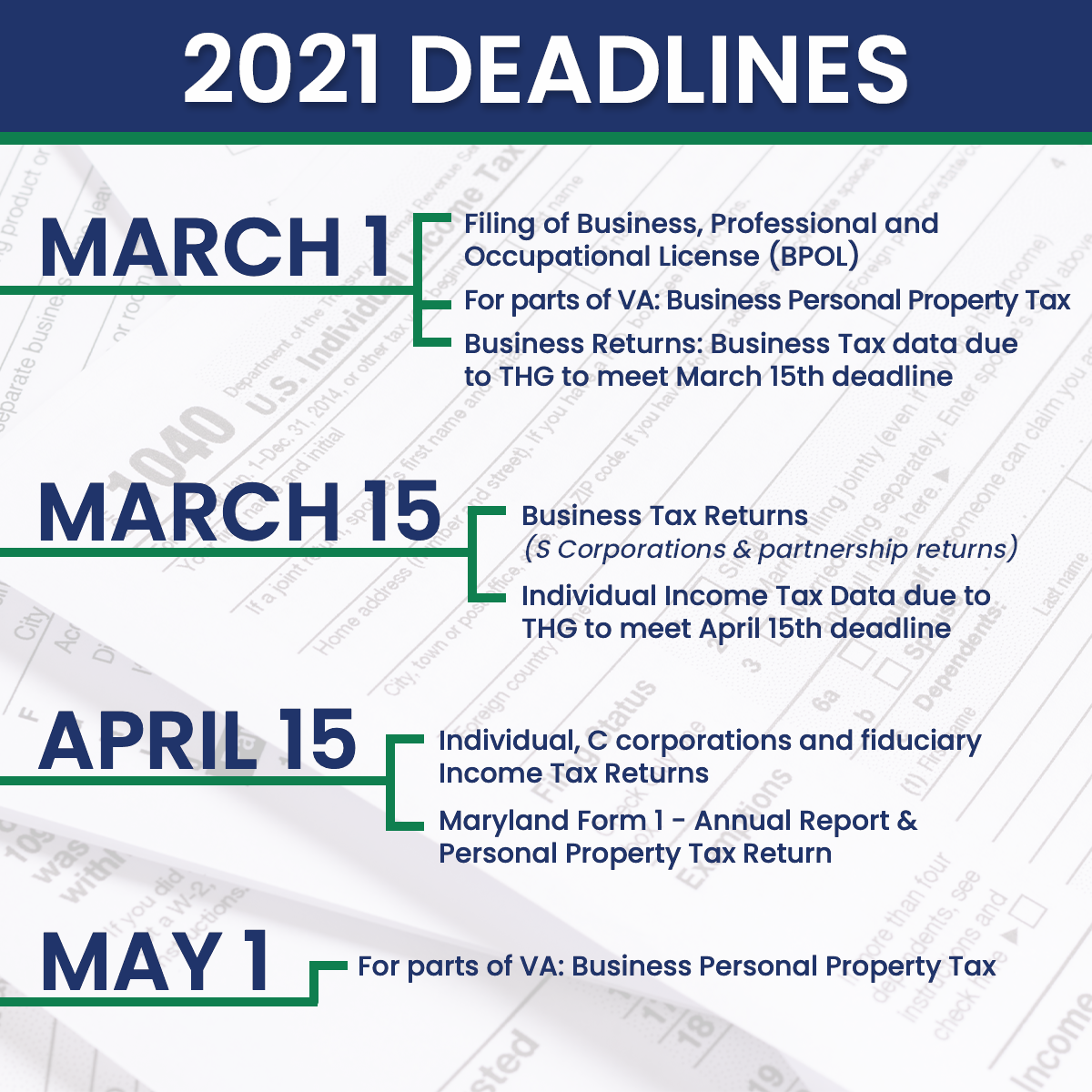

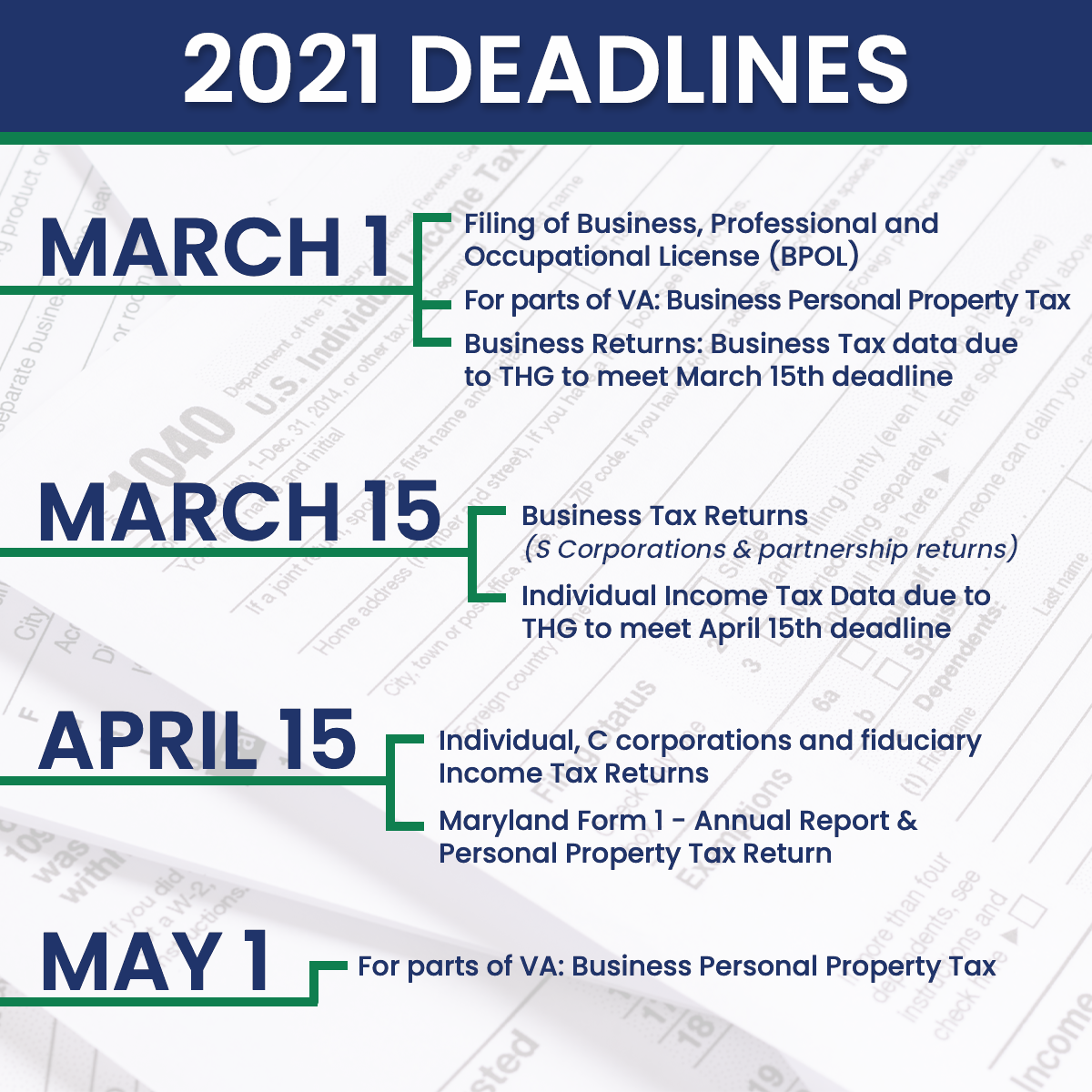

Below are the 2021 Tax Deadlines for The Hopkins Group.

Below are the 2021 Tax Deadlines for The Hopkins Group.

Virtual currency is a digital representation of value that functions as a medium of exchange, a unit of account, and/or a store of value. Sometimes it operates like real currency but it does not have legal tender status in any jurisdiction.

Cryptocurrency is a type of virtual currency that utilizes cryptography to validate and secure transactions that are digitally recorded on a distributed ledger, like a blockchain.

Transactions are taxable by law just like transactions in any other property and taxpayers may have to report those transactions on their tax returns.

Bitcoin is a convertible virtual currency that can be digitally traded between users and purchased for, or exchanged into, U.S. dollars, Euros, and other real or virtual currencies.

© 2025 All Rights Reserved. Website by Threshold Media