Due April 18th

File 2021 Tax Return Pay Quarterly Estimated Taxes

Pay 2021 Taxes Due Request 6-Month Filing Extension

Contribute to Individual Retirement Account (IRA) for 2021

Contribute to Health Savings Account (HSA) for 2021

Contribute to Solo 401(k) Plan or Simplified Employee Pension (SEP)

Plan for 2021 by Self-Employed if Form 1040 Is Not Extended

Author: Julie Pinches

Child Tax Credit Portal

If you received advance payments of the Child Tax Credit, you need to reconcile the total you received with the amount you’re eligible to claim on your 2021 income tax returns. Unsure if you received the advance child tax credits? Go to the IRS portal to confirm. You will go through an extensive identity check when you login via ID.ME, but the records should be accurate.

PPO Loan Law Update

During the 2022 Virginia General Assembly Session, legislation was enacted to conform with the Internal Revenue Code’s Covid-19 response legislation. Tax Bulletin 22-1 was released on February 23, 2022 and provides in depth information about the relief. Here are some important updates about the treatment of forgiven Paycheck Protection Program (PPP) proceeds:Taxable Year 2020: The law remains the same – a Virginia-specific deduction for $100,000 in business expenses that were paid or incurred and are funded by forgiven PPP proceeds during Taxable Year 2020, is allowable on the 2020 tax returns. Taxable Year 2021: Virginia will conform to the federal tax law treatment of the COVID-19 business assistance programs for tax year 2021 and after. No adjustment is required on the 2021 Virginia income tax returns for taxpayers that have business expenses funded by forgiven PPP loan proceeds, EIDL program funding, and Restaurant Revitalization grants during 2021.

HSA with Medicare

HSAs (Health Savings Accounts) are accounts for individuals with high-deductible health plans (HDHPs). Contributions to HSAs are tax deductible up to an annual limit, and distributions made to cover out-of-pocket medical costs are not taxed.

If you enroll in Medicare Part A and/or B during the year, you can no longer contribute pre-tax dollars to your HSA. However, if you are approaching Medicare enrollment, we suggest you make your full annual contribution before Medicare begins. You will be able to utilize all of your funds, just not make any additional contributions.

If you choose to delay Medicare enrollment because you are still working and want to continue contributing to your HSA, you must also wait to collect Social Security retirement benefits. This is because most individuals who are collecting Social Security benefits when they become eligible for Medicare are automatically enrolled into Medicare Part A. You cannot decline Part A while collecting Social Security benefits.

Finally, if you decide to delay enrolling in Medicare, make sure to stop contributing to your HSA at least six months prior to Medicare enrollment. When you enroll in Medicare Part A, you receive up to six months of retroactive coverage, not going back farther than your initial month of eligibility. If you do not stop HSA contributions at least six months before Medicare enrollment, you may incur a tax penalty.

401(k) Advantage for Ages 50+

Once you turn 50 years old you are entitled to a 401(k) Catch-Up Contribution and can contribute a total of $26,000 now! The 2021 contribution limit for employees is $19,500 and the Catch-up Contributions for ages 50+ has increased to $6,500. If you are eligible it’s a smart investment.

Employee Retention Tax Credit (ERTC): Is Your Company Eligable?

We can help amend 2020 Q2-Q4 quarterly returns and the 2021 Q1 quarterly returns (and possibly Q2) for any amounts that are eligible based on any of the following reasons:

- Operations partially/fully suspended due to COVID

- Reduction in gross receipts (calendar quarter), 20% (2020) / 50% (2021)

- Business closed and lost business for a determined period of time

How to Avoid Withholding Penalties

Underpaying your tax liability can result in unnecessary penalties. Two simple ways to avoid the penalty are:

- Pay 100-110% of the tax liability shown on the return for the prior year, depending on your adjusted gross income for that year; or

- Pay at least 90% of your current year tax.

It is hard to know exactly what your tax liability will be for the current year so often times, the first safe harbor is the easiest benchmark to use. However, this becomes challenging when the prior year tax liability is abnormally high due to a big financial event. We can assist you with determining what your estimated tax payments need to be.

2021 Tax Changes (RMDs, 1099NEC)

RMDs new required age is 72

The Secure Act made changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72. Please note that if you delay your first distribution to April 1 of the year after you reach 72, you will be required to take two distributions in one year.

New 1099-NEC Form

Beginning in 2020, Form 1099-NEC is the new form to report independent contractor income. The 1099-MISC form will be used to report miscellaneous income such as rent or legal fees. If you filed Form 1099-MISC in error, you should correct this by amending Form 1099-MISC and reissuing Form 1099-NEC.

COVID Programs (PPP/EIDL/PUA)

In 2020 new programs were created to help small businesses including forgiven loans, grants, and unemployment benefits.

PPP Forgiven Loan

The CARES Act states the forgiven loan amount will not be included in your taxable income and you will not pay taxes on the money received. The second stimulus bill on December 27, 2020 clarified how the expenses covered by a PPP loan will be treated. Previously, IRS guidance stated anything you spent your PPP loan proceeds on were not going to be tax deductible. Congress clarified that – now your expenses are tax deductible. Schedule C filers will not be impacted by their PPP forgiven loans.

EIDL Grant

The second stimulus bill clarified that the EIDL grant will also be tax-free and will not need to be included in your taxable income. An EIDL loan will be treated the same way as any other loan.

Pandemic Unemployment Assistance (PUA) and Unemployment

PUA and Unemployment benefits are considered taxable income. You will pay state and federal taxes on money you received, but will not have to pay medicare or social security taxes on the income.

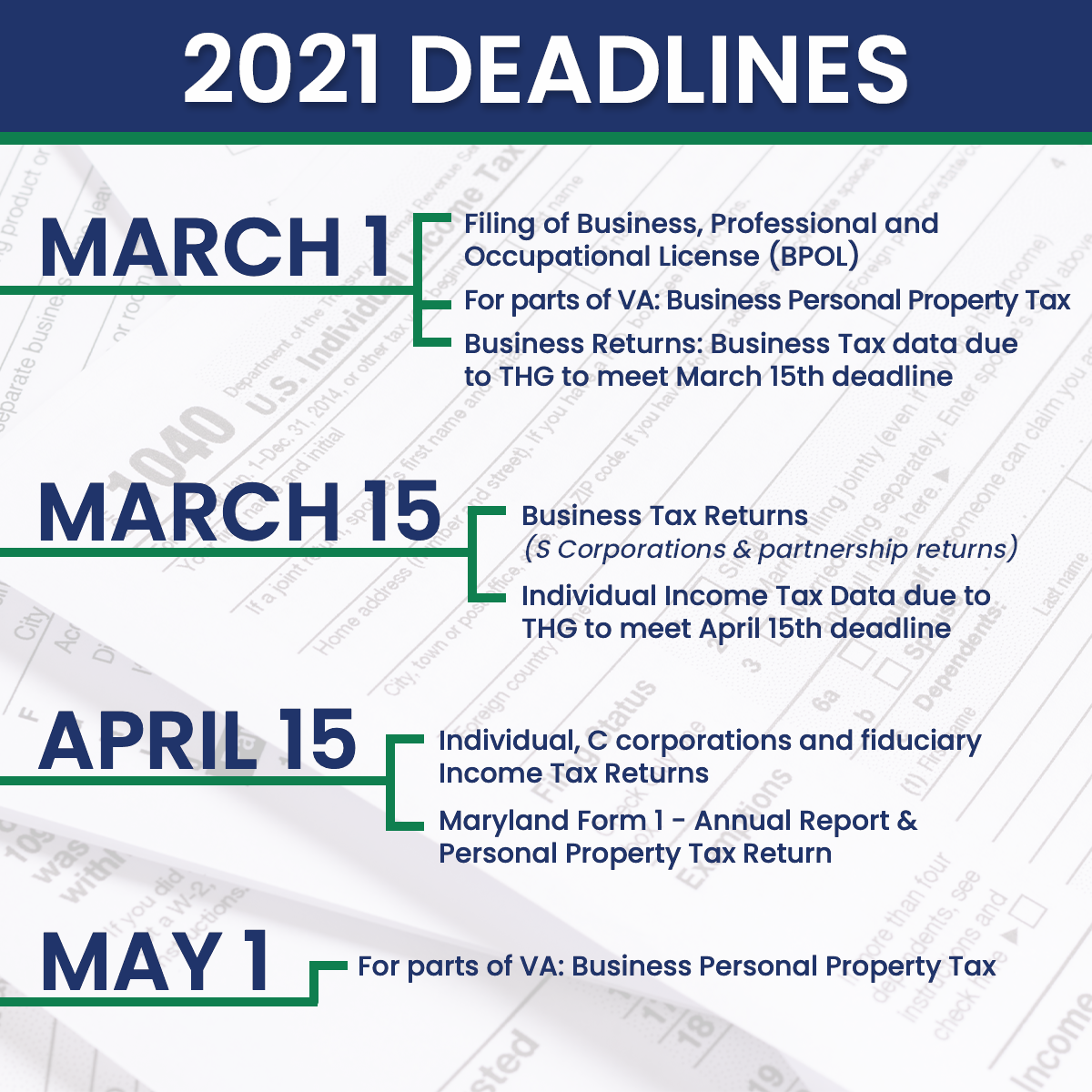

2021 Tax Deadlines

Below are the 2021 Tax Deadlines for The Hopkins Group.